Using Average Income to Price Your Units

How To Determine the Price Of Rent

Let’s say you’re determining the price of rent for various apartments in a multifamily property. You want to base this on many factors including the location, asset class, etc. Another one of those factors might be the average income for that area. There are many ways of determining that average. Which one is going to the better choice in the context of setting the price of your lease?

A. The mean

B. The mode

C. The median

Answer: The mode

You may or may not be surprised with this answer. The fact of the matter is that a mean and median is meaningless for a real estate investor because it doesn’t tell much about various income groups within the population. You could have an extremely large number of people that make $20,000 a year and another population that makes over $100,000. Your mean will fall fairly close to the middle close to perhaps $70,000, yet you don’t actually have a significant population of people that fall within this income bracket. For a median, depending on which population is larger, it will either be too high or too low. If you have a property with unit values suitable to people with $70,000 incomes, you might not have any buyers because it’s too expensive for some and not the right quality for others. In the end, you don’t want a single average.

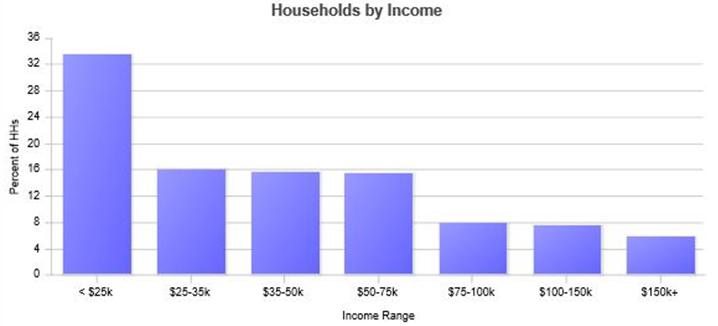

With a mode, you can have more than one mode that represents various income brackets and you can quantify how many fall into each bracket. The mode is quantifying, “the most frequent.” The most successful properties in our example area will either be very cheap or very expensive properties because of the two income-bracket populations that live in that area. The more modes you track, the more detailed view of the population you will get. It might look something like this…

*This graph shows an example of what segmentation of salary levels looks like. It is not derived from the example in the article.